Sifiso Skenjana | Moody's downgraded SA. What happens now?

News24

28 Mar 2020, 14:43 GMT+10

Moody's Ratings Agency has downgraded South Africa's sovereign credit rating to sub-investment grade from Baa3 to Ba1 (also known as junk status).

It has been almost three years since Fitch Ratings (07 April 2017) and Standard & Poor's Ratings (03 April 2017) downgraded South Africa's sovereign credit rating to below investment grade following a Cabinet reshuffle by then-president Jacob Zuma, which saw then Finance Minister Pravin Gordan and Deputy Mcebisi Jonas being fired from their positions.

The downgrade means that South African government bonds would ordinarily be removed from the WGBI, resulting in outflows which on the top end could be as much as $11 billion. However, FTSE Russel, which administers the WGBI, have put a pause on the portfolio rebalancing (ie removing SA Govt Bonds) for at least a month. The February WGBI factsheet reported that SA government bonds had a cumulative weighting of 4.43% of the WGBI.

Parallels from Brazil

Many of the structural challenges that were facing the Brazilian economy prior to their sovereign credit downgrade by Moody's Ratings Agency are similar to the ones observed in the South African economy. High debt to GDP levels, an economy in recession, widening budget deficits and a weaker currency trend against the mainstream currencies - the US dollar, the British Pound and the Euro.

Moody's was the last ratings agency to downgrade Brazil. Brazil's budget deficit had breached 10% by the time the downgrade came in February 2016 and debt to GDP rose from 65% to 77% post the downgrade. However, the currency remained relatively resilient given that most of the risk had already been priced in their bond yields prior to the downgrade.

Downgrade already priced in

The local currency has weakened by approximately 25% since January this year, having traded at R14.01 to the US$ on the 31st December 2019 to trading at R17.57 by close of business on 27 March 2020.

Through a separate lens, the 2018 Ramaphoria saw South Africa's five-year sovereign credit default spread narrow to its lowest levels in five years, while this year has seen these widen significantly since January to the highest five-year level on 23 March 2020.

When credit spreads widen, it's a sign that investors are pricing poor credit quality for South Africa. The coronavirus pandemic contributed materially to the widening of the spreads - accelerating South Africa's journey towards a sovereign credit downgrade. This means that investors have broadly priced in the downgrade and a large portion of it should be reflected in the current long-term government bond yields.

Yield seeking portfolio flows likely to continue

South Africa is the highest-yielding currency on in the basket of 14 currencies in the WGBI, making South African bonds still relatively attractive for high yield seeking investors. And given that most all the developed economy are expected to have an accommodative interest rate policy environment further strengthens the case for South African bonds as a high yield investment destination.

In addition, inflation has tracked below the mid-point of 4.5% that the SARB models as an inflation target.

This suggests that any inflationary effects that follow as a result of the credit ratings downgrade are unlikely to result in price instability or hyperinflation.

Forex Brokers SA reported that the South African Rand last year ranked 18th (previously 20th) most traded currency in the world, with an average daily traded volume of US$72 billion - of which 84% was traded by international investors, the highest of any of the BRICS nations.

An unencumbered economic opportunity

Had Moody's deferred their decision; the economy would have continued in the ratings paralysis it had found itself in recent times, continuously plugging holes just to stave off a ratings downgrade.

Policy makers now, more than ever, have the opportunity to grab this bear market by its fur and start planning the structural reconfiguration of our economy. A strategy to grow long run aggregate supply needs an economy that best utilises its factors of production - land, capital, labour and technical innovation.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Detroit Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Detroit Star.

More InformationInternational

SectionDeadly July 4 flash floods renew alarm over NWS staffing shortages

WASHINGTON, D.C.: After months of warnings from former federal officials and weather experts, the deadly flash floods that struck the...

Putin fires transport chief, later found dead in suspected suicide

MOSCOW, Russia: Just hours after his sudden dismissal by President Vladimir Putin, Russia's former transport minister, Roman Starovoit,...

Thousands gather in Himalayas as Dalai Lama celebrates 90th birthday

DHARAMSHALA, India: The Dalai Lama turned 90 on July 6, celebrated by thousands of followers in the Himalayan town of Dharamshala,...

Fans perform WWII-era Fascist salute at Marko Perković’s mega concert

ZAGREB, Croatia: A massive concert by popular Croatian singer Marko Perković, known by his stage name Thompson, has drawn widespread...

U.S. Treasury Secretary says Musk should steer clear of politics

WASHINGTON, D.C.: Elon Musk's entry into the political arena is drawing pushback from top U.S. officials and investors, as his decision...

TikTok building U.S.-only app amid pressure to finalise sale

CULVER CITY, California: TikTok is preparing to roll out a separate version of its app for U.S. users, as efforts to secure a sale...

Michigan

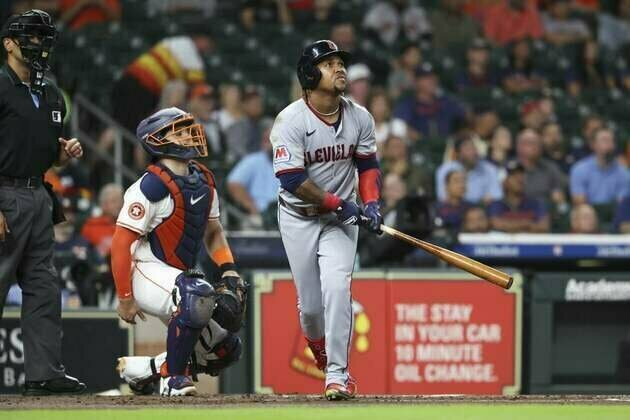

SectionGuardians 3B Jose Ramirez pulls out of All-Star Game

(Photo credit: Troy Taormina-Imagn Images) Cleveland Guardians third baseman Jose Ramirez on Wednesday pulled out of next week's...

Oilers, Lightning swap first-round picks Sam O'Reilly, Isaac Howard

(Photo credit: Matthew Dae Smith/Lansing State Journal / USA TODAY NETWORK via Imagn Images) The Edmonton Oilers acquired reigning...

Time to go: Orban demands von der Leyens departure

The Hungarian PM mocked the EU chief ahead of Thursdays no confidence vote over her handling of vaccine deals Hungarian Prime Minister...

Guardians seek to close series against Astros with a sweep

(Photo credit: Troy Taormina-Imagn Images) With Houston closer Josh Hader having last worked on Saturday and the Astros set for an...

Tigers eye win No. 60 in series finale vs. Rays

(Photo credit: Matt Krohn-Imagn Images) The streaking Detroit Tigers can reach the 60-win mark as early as Wednesday when they host...

The Great Lakes are powerful. Learning about 'rip currents' can help prevent drowning

Between 2010 and 2017, there were approximately 50 drowning fatalities each year associated with rough surf and strong currents in...