Professional Holding Corp. Reports First Quarter Results

ACCESS Newswire

18 May 2020, 18:35 GMT+10

Successfully Completes Acquisition, Closes Initial Public Offering, and Responds to COVID-19

CORAL GABLES, FL / ACCESSWIRE / May 18, 2020 / Professional Holding Corp. (the 'Company') (NASDAQ:PFHD), the parent company of Professional Bank (the 'Bank'), today announced its first quarter 2020 financial results.

'This was an exciting quarter for the Company. We completed our initial public offering and closed our acquisition of Marquis Bancorp, Inc.,' said Daniel R. Sheehan, Chairman and Chief Executive Officer of the Company. 'While the onset of the COVID-19 pandemic has taken a toll on the greater economy, our business model has enabled us to address the needs of our clients and community.'

Results of Operations:

For the first quarter of 2020:

- Net interest income was $7.2 million, an increase of $0.6 million, or 8.8%, compared to the same period in 2019. Loan growth, partially offset by an increase in total deposits, was primarily responsible for the increase.

- We had a net loss of $1.3 million, compared to net income of $0.4 million during to the same period in 2019. Expenses related to the Company's acquisition of Marquis Bancorp, Inc. ('MBI') and increases to the Company's provision for loan losses were primarily responsible for the decrease.

- Adjusted net income (non-GAAP, see explanation of certain non-GAAP financial measures unaudited) of $183,000 for the current quarter, compared to $355,000 during the same period in 2019. Adjusted net income per share (non-GAAP) of $0.02 for the current quarter, compared to $0.06 per share during the same period in 2019. For the current quarter net income per share was $(0.14) per, compared to $0.06 per share during the same period in 2019.

- Noninterest income totaled $0.9 million, an increase of $0.5 million, or 137.8%, compared to the same period in 2019. Increases in service charges on deposit accounts and increases in interest rate SWAP referral fees were primarily responsible for the increase.

- Noninterest expense totaled $9.5 million, an increase of $3.0 million, or 45.7%, compared to the same period in 2019. Increases in employee headcount and MBI acquisition expenses were primarily responsible for the increase.

Financial Condition:

At March 31, 2020:

- Total assets increased to $1.7 billion, an increase of $618.9 million, or 58.8%, compared to December 31, 2019. The completion of the acquisition of MBI largely contributed to the increase.

- Net loans increased to $1.3 billion, an increase of $557.9 million, or 71.1%, compared to December 31, 2019. The Company experienced growth across all loan categories, primarily due to the acquisition of MBI.

- Nonperforming assets totaled $4.0 million, which included one loan classified as nonperforming and another loan as 90 days past due compared to three loans classified as nonperforming and no loans over 90 days past due, as of December 31, 2019.

- The Company maintained its strong capital position. As of March 31, 2020, the Company was well-capitalized with a total risk-based capital ratio of 14.0%, a tier 1 risk-based capital ratio of 13.3%, a common equity tier 1 capital ratio of 10.5%, and a leverage ratio of 13.3%. As of December 31, 2019, the Company's capital ratios exceeded the thresholds required for a well-capitalized designation under applicable bank regulatory requirements.

COVID-19 Operational Response and Bank Preparedness:

- In early March 2020, the Company began preparing for potential disruptions and government limitations of activity. Preparations included: (i) conducting pandemic testing, (ii) publishing a 'work from home' guide, (iii) phasing in remote operations with a focus on employee safety, redundancy, and business continuity, and (iv) hardware upgrades. The hardware upgrades included increased mobile/laptop capabilities, increased VPN licenses & bandwidth, and expanded technologies for video and conference line functionality.

- The Company initiated a modified schedule for branches and limited client entry into the branches. Transactions are now taken at the door and employees are restricted from working at multiple offices. Since early March 2020, approximately 80% of Company employees are working remotely.

- To manage credit risk, the Company increased oversight and analysis of $15.4 million of loans to borrowers in vulnerable industries such as hotels and hospitality. To date, these loans continue to perform according to their terms.

- The Company participated in the SBA Paycheck Protection Program and processed/closed/funded over 1,300 loans representing over $215 million in relief proceeds. These loans were subsequently pledged to the Federal Reserve as part of the Paycheck Protection Program Liquidity Facility (PPPLF). The PPPLF pledged loans are non-recourse to the Bank.

- As of April 30, 2020, we have reviewed and processed 125 debt service relief requests in accordance with Interagency guidelines published on March 13, 2020. As currently interpreted by the agencies, the guidelines assert that short-term modifications made on good faith for reasons related to the COVID-19 pandemic to borrowers who were current prior to such relief are not considered TDRs. These modifications include deferrals of principal and interest, modification to interest only, and deferrals to escrow requirements. The modifications have varying terms up to six months. Of the 125 loans that were reviewed and processed 96 were payment deferments. At April 30, 2020, residential loans represented 63 of the processed requests with balances totaling $45.8 million. At April 30, 2020, the overall various debt service relief approvals represented approximately 11% of the total loan portfolio and loan deferrals represented 7% of the total loan portfolio.

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

(Dollar amounts in thousands, except per share data)

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (Unaudited)

(Dollar amounts in thousands, except per share data)

Capital

The following table presents the Company's regulatory capital ratios as of March 31, 2020, and December 31, 2019. The amounts presented exclude the capital conservation buffer.

Liquidity

The Company maintains a strong liquidity position. At March 31, 2020, in addition to its balance sheet liquidity, the Company had the ability to generate approximately $206.1 million in additional liquidity through available resources.

Net Interest Income and Net Interest Margin Analysis

The following table shows the average outstanding balance of each principal category of the Company's assets, liabilities and shareholders' equity, together with the average yields on assets and the average costs of liabilities for the periods indicated. Such yields and costs are calculated by dividing the annualized income or expense by the average daily balances of the corresponding assets or liabilities for the respective periods.

- Includes nonaccrual loans.

- Net interest spread is the difference between interest rates earned on interest earning assets and interest rates paid on interest-bearing liabilities.

- Net interest margin is a ratio of net interest income to average interest earning assets for the same period.

- Interest income on loans includes loan fees of $55 and $127 thousand for the three months ended March 31, 2020 and 2019, respectively.

Provision for Loan Losses

The Company's provision for loan losses amounted to $0.85 million for the first three months of 2020 compared to $(0.11) million for the first three months of 2019. The negative net allocation for the first three months of 2019 was due to a reclassification of unallocated funds of $384,000 after a provision expense of $273,000. The increase to the provision expense in 2020 reflects an increase in loan growth, increased uncertainty surrounding COVID-19, and the deteriorating general macroeconomic environment.

The Company's allowance for loan losses as a percentage of total loans was 0.55% at March 31, 2020, compared to 0.83% at December 31, 2019. This decrease reflects the loan growth resulting from the acquisition of MBI. As part of the acquisition, all Marquis loans had specific allocations marked upon the close of the acquisition and do not require a specific reserve. The Company did not record any net charge-offs for the three months ended March 31, 2020, or March 31, 2019.

Noninterest Income

Noninterest income for the three months ended March 31, 2020, was $0.9 million, a $496,000, or 137.8%, increase compared to noninterest income of $0.4 million for the three months ended March 31, 2019. An increase in swap referral fees of $263,000, or 100.0%, during the first three months of 2020 compared to none for the first three months of 2019 was the primary reason for this increase. A few large loans generated these swap referral fees, and it is uncertain whether the Company will be able to sustain any increases in the future. The Company's primary sources of recurring noninterest income are service charges on deposit accounts, mortgage banking revenue, swap referral fees, origination fees for Small Business Administration, or SBA loans, and other fees and charges.

The Company also experienced an increase in mortgage banking revenues of $83,000 or 136.1%, primarily due to originating and selling fixed rate15-year and 30-year loans to third parties and an increase in deposit account service charges of $62,000, or 38.8%. A decrease in SBA loan origination fees of $14,000, or (100.0)%, during the 2020 period compared to the 2019 period slightly offset these increases.

Noninterest Expense

Noninterest expense amounted to $9.5 million for the three months ended March 31, 2020, an increase of $3.0 million, or 45.7%, compared to $6.5 million for the three months ended March 31, 2019. Expenses associated with the acquisition of MBI were the primary reason for this increase. Additional contributing factors include increased salaries and benefits, increased employee headcount, increased occupancy and equipment expenses, and professional services expenses attributable to building the infrastructure of a publicly traded company. Generally, noninterest expense is composed of all employee expenses and costs associated with operating Company facilities, obtaining and retaining client relationships and providing banking services.

Investment Securities

The Company's investment portfolio increased by $70.7 million, or 238.5%, from $29.6 million at December 31, 2019, to $100.3 million at March 31, 2020. The investment of a portion of the proceeds from the Company's 2020 initial public offering is the primary reason for this increase. The Company invested these proceeds into liquid assets to provide more liquidity to fund loan growth, as well as securities available for sale. To supplement interest income earned on the Company's loan portfolio, the Company invests in high quality mortgage-backed securities, government agency bonds, corporate bonds, community development district bonds and equity securities (including mutual funds).

Loan Portfolio

The Company's primary source of income is derived from interest earned on loans. The Company's loan portfolio consists of loans secured by real estate as well as commercial business loans, construction and development loans, and other consumer loans. The Company's loan clients primarily consist of small to medium sized businesses, the owners and operators of those businesses, and other professionals, entrepreneurs and high net worth individuals. The Company's owner-occupied and investment commercial real estate loans, residential construction loans, and commercial business loans provide higher risk-adjusted returns, shorter maturities, and more sensitivity to interest rate fluctuations and are complemented by the relatively lower risk residential real estate loans to individuals. The Company's lending activities are principally directed to the Miami-Dade MSA. The following table summarizes and provides additional information about certain segments of the Company's loan portfolio as of March 31, 2020, and December 31, 2019.

Non-Performing Assets

As of March 31, 2020, the Company had nonperforming assets of $4.0 million, or 0.26% of total assets compared to nonperforming assets of $2.3 million, or 0.22% of total assets at December 31, 2019.

Allowance for Loan and Lease Losses ('ALLL')

The Company's allowance for loan losses was $7.4 million at March 31, 2020, compared to $6.5 million at December 31, 2019, an increase of 12.9%. The organic growth of the Company's loan portfolio and the anticipated decline in worldwide economic activity due the actual and projected effects of COVID-19 were primarily responsible for this increase. At December 31, 2019, the Company had an allowance for loan losses to total gross loans (net of overdrafts) ratio of 0.83%. At March 31, 2020, the Company's allowance for loan losses was 0.55% of total gross loans (net of overdrafts) and provided coverage of 391.4% of nonperforming loans. The Company believes the allowance at March 31, 2020, was adequate to absorb probable incurred credit losses inherent in the loan portfolio.

Explanation of Certain unaudited non-GAAP Financial Measures

This press release contains financial information determined by methods other than U.S. Generally Accepted Accounting Principles ('GAAP'), including adjusted net income and adjusted net income per share, which we refer to 'non-GAAP financial measures.' The table below provides a reconciliation between these non-GAAP measures and net income and net income per share.

Management uses these non-GAAP financial measures in its analysis of the Company's performance and believes these measures are useful supplemental information that can enhance investors' understanding of the Company's core business and performance without considering acquisition-related expenses. Management believes it is appropriate to exclude acquisition related expenses because those costs are specific to each transaction and are differentiated by the size, complexity and other specifics of each transaction, and are not indicative of the costs to operate the Company's core business. These non-GAAP measures can be useful when comparing performance with other financial institutions. These disclosures should not be considered an alternative to GAAP.

Reconciliation of non-GAAP Financial Measures (unaudited)

Dollar amount in thousands, except per share data

Acquisition related expenses are comprised of change-in-control payments to Marquis executives and advisory, legal, and regulatory fees and costs.

Additional Materials

The Company's Quarterly Report on Form 10-Q can be found on the Company's investor relations web page at https://myprobank.com/ir/ or on the SEC web page at https://www.sec.gov. There is also a slide presentation with supplemental financial information that can be accessed at https://myprobank.com/ir/. Management intends to hold regular quarterly conference calls with investors commencing after the second quarter of 2020.

Forward Looking Statements

This communication contains forward-looking statements involving significant risks and uncertainties. Several important factors could cause actual results to differ materially from those in the forward-looking statements. Those factors include the duration and extent of the COVID-19 pandemic, general economic and financial market conditions, potential business uncertainties as we integrate MBI into our operations, expectations concerning and the actual timing and amount of interest rate movements, competition, our ability to execute business plans, geopolitical developments, legislative and regulatory developments, inflation or deflation, market fluctuations, natural disasters (including pandemics such as COVID-19), critical accounting estimates, and other factors listed in our Form 10-K for the year ended December 31, 2019, and other filings with the Securities and Exchange Commission. The Company disclaims any obligations to update any such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments or changes in expectations, except as may be required by law.

About Professional Holding Corp.

Professional Holding Corp. (NASDAQ:PFHD), is the financial holding company for Professional Bank, a Florida state-chartered bank established in 2008. Professional Bank focuses on providing creative, relationship-driven commercial banking products and services designed to meet the needs of small to medium-sized businesses, the owners and operators of these businesses, other professional entrepreneurs and high net worth individuals. Professional Bank currently operates through a network of five banking centers and four loan production offices in the Miami Metropolitan Statistical Area, as well as its Digital Innovation Center located in Cleveland, Ohio. For more information, visit www.myprobank.com.

Media Contacts:

Todd Templin

[email protected]

954-370-8999

Eric Kalis

[email protected]

954-370-8999

SOURCE: Professional Holding Corp.

View source version on accesswire.com:

https://www.accesswire.com/590214/Professional-Holding-Corp-Reports-First-Quarter-Results

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Detroit Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Detroit Star.

More InformationInternational

SectionOver 60 companies named in UN report on Israel-Gaza conflict

GENEVA, Switzerland: A new United Nations report alleges that dozens of global corporations are profiting from and helping sustain...

UK lawmakers desigate protest group as terrorist organization

LONDON, UK - Lawmakers in the United Kingdom have voted overwhelmingly to proscribe the direct-action group Palestine Action as a terrorist...

Dalai Lama to address Buddhist conference, reveal succession plan

DHARAMSHALA, India: The Dalai Lama is set to address a significant three-day conference of Buddhist leaders this week, coinciding with...

US Supreme Court backs Texas efforts to shield minors online

WASHINGTON, D.C.: In a significant ruling last week, the U.S. Supreme Court upheld a Texas law requiring age verification for users...

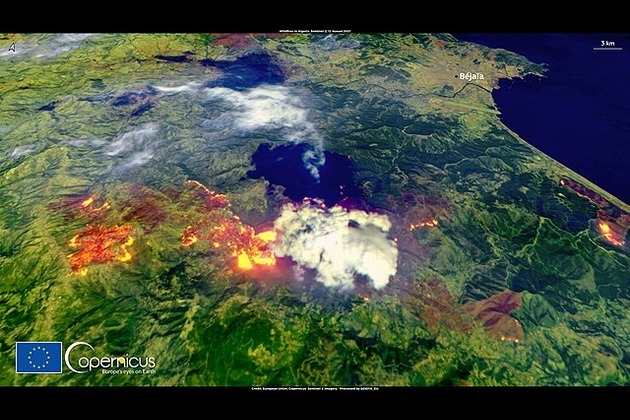

Turkey, France battle wildfires amid early Europe heatwave

ISTANBUL/PARIS/BRUSSELS: As searing temperatures blanket much of Europe, wildfires are erupting and evacuation orders are being issued...

Venetians protest Bezos wedding with march through the town

VENICE, Italy: Over the weekend, hundreds of protesters marched through the narrow streets of Venice to voice their opposition to billionaire...

Michigan

SectionDozens of MEPs ready to vote no confidence in von der Leyen media

The European Commission president has been under scrutiny over a Pfizergate Covid-19 vaccine scandal The Members of the European...

EU lawmakers back no confidence vote against von der Leyen media

The European Commission president has been damaged by the ongoing Pfizergate Covid-19 vaccine scandal Members of the European Parliament...

Russian ally names first step towards Ukraine ceasefire

Belarusian President Alexander Lukashenko says the US could order Zelensky to suspend strikes if it truly seeks to end the conflict...

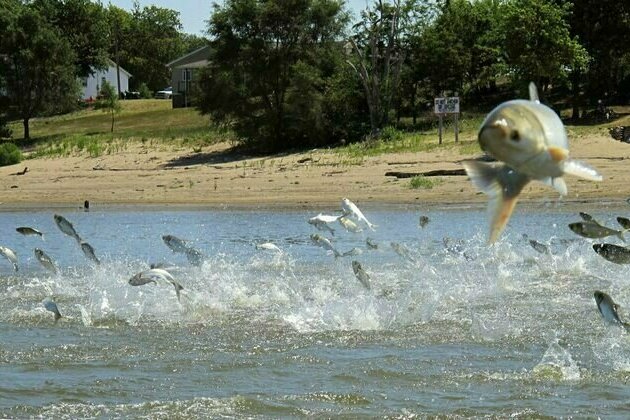

Invasive carp threaten the Great Lakes - and reveal a surprising twist in national politics

In his second term, President Donald Trump has not taken many actions that draw near-universal praise from across the political spectrum....

Akshay Bhatia makes the cut in Rocket Classic on the line

Detroit,[US], June 29 (ANI): Three birdies on the back nine helped Akshay Bhatia make the cut on the line at the Rocket Classic on...

Roundup: DR Congo, Rwanda sign peace deal to end regional bloody turmoil

The Democratic Republic of the Congo (DRC) and Rwanda signed a historic peace agreement in Washington on Friday to end years of armed...