Monterey Capital Acquisition Corporation Announces Pricing of $80,000,000 Initial Public Offering

ACCESS Newswire

11 May 2022, 03:43 GMT+10

MONTEREY, CA / ACCESSWIRE / May 10, 2022 / Monterey Capital Acquisition Corporation (the 'Company') announced today that it priced its initial public offering of 8,000,000 units at $10.00 per unit. The units will be listed on the Nasdaq Global Market ('Nasdaq') and will begin trading tomorrow, May 11, 2022, under the ticker symbol 'MCACU'. Each unit consists of one share of Class A common stock, one redeemable warrant and one right to receive one-tenth (1/10) of one share of Class A common stock upon consummation of the Company's initial business combination. Each warrant entitles the holder thereof to purchase one share of Class A common stock at a price of $11.50 per share. Once the securities comprising the units begin separate trading, shares of the Class A common stock, warrants and rights are expected to be listed on Nasdaq under the symbols 'MCAC', 'MCACW' and 'MCACR', respectively.

EF Hutton, division of Benchmark Investments, LLC ('EF Hutton'), is acting as the sole book running manager for the offering. The Company has granted the underwriter a 45-day option to purchase up to an additional 1,200,000 units at the initial public offering price to cover over-allotments, if any. The offering is expected to close on May 13, 2022, subject to customary closing conditions.

Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C. is serving as legal counsel to the Company. Seward & Kissel LLP is serving as counsel to EF Hutton.

The offering is being made only by means of a prospectus. Copies of the prospectus may be obtained, when available, from EF Hutton, Attn: Syndicate Department, 590 Madison Ave., 39th Floor, New York, New York 10022, by telephone at (212) 404-7002, by fax at (646) 861-4697, or by email at [email protected].

A registration statement on Form S-1 (File No. 333-264460) relating to these securities has been filed with, and declared effective by, the Securities and Exchange Commission ('SEC') on May 10, 2022. A final prospectus relating to this offering will be filed with the SEC. This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

ABOUT MONTEREY CAPITAL ACQUISITION CORPORATION

The Company is a newly organized blank check company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. While it may pursue an initial business combination target in any business, industry, or geographical location, the Company intends to focus its search on businesses in the clean transition sector. The Company is led by Bala Padmakumar, the Company's Chief Executive Officer and Chairman of the Board, Vivek Soni, the Company's Executive Vice President and Director, and Daniel Davis, the Company's Chief Financial Officer.

FORWARD-LOOKING STATEMENTS

This press release contains statements that constitute 'forward-looking statements,' including with respect to the Company's initial public offering. No assurance can be given that the offering discussed above will be completed on the terms described, or at all. Forward-looking statements are subject to numerous conditions, many of which are beyond the control of the Company, including those set forth in the Risk Factors section of the Company's registration statement and preliminary prospectus for the offering filed with the SEC. Copies are available on the SEC's website, www.sec.gov. The Company undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law.

Company Contact:

Bala Padmakumar

Chief Executive Officer and Chairman of the Board

Monterey Capital Acquisition Corporation

Email: [email protected]

Phone: (831) 649-7388

SOURCE: Monterey Capital Acquisition Corporation

View source version on accesswire.com:

https://www.accesswire.com/700818/Monterey-Capital-Acquisition-Corporation-Announces-Pricing-of-80000000-Initial-Public-Offering

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Detroit Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Detroit Star.

More InformationInternational

SectionNative leaders, activists oppose detention site on Florida wetlands

EVERGLADES, Florida: Over the weekend, a diverse coalition of environmental activists, Native American leaders, and residents gathered...

Beijing crowds cheer AI-powered robots over real soccer players

BEIJING, China: China's national soccer team may struggle to stir excitement, but its humanoid robots are drawing cheers — and not...

COVID-19 source still unknown, says WHO panel

]LONDON, U.K.: A World Health Organization (WHO) expert group investigating the origins of the COVID-19 pandemic released its final...

Fox faces $787 million lawsuit from Newsom over Trump phone call

DOVER, Delaware: California Governor Gavin Newsom has taken legal aim at Fox News, accusing the network of deliberately distorting...

DeepSeek faces app store ban in Germany over data transfer fears

FRANKFURT, Germany: Germany has become the latest country to challenge Chinese AI firm DeepSeek over its data practices, as pressure...

Canadian option offered to Harvard graduates facing US visa issues

TORONTO, Canada: Harvard University and the University of Toronto have created a backup plan to ensure Harvard graduate students continue...

Michigan

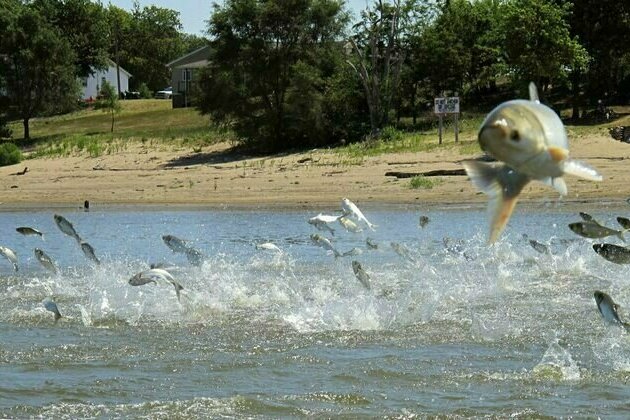

SectionInvasive carp threaten the Great Lakes - and reveal a surprising twist in national politics

In his second term, President Donald Trump has not taken many actions that draw near-universal praise from across the political spectrum....

Akshay Bhatia makes the cut in Rocket Classic on the line

Detroit,[US], June 29 (ANI): Three birdies on the back nine helped Akshay Bhatia make the cut on the line at the Rocket Classic on...

Roundup: DR Congo, Rwanda sign peace deal to end regional bloody turmoil

The Democratic Republic of the Congo (DRC) and Rwanda signed a historic peace agreement in Washington on Friday to end years of armed...

Von der Leyen faces possible no confidence vote FT

The European Commission president has been under scrutiny over a multi-billion-dollar Covid-19 vaccine deal A group of lawmakers...

Von der Leyen faces possible no confidence vote FT

The European Commission president has been under scrutiny over a multi-billion-dollar Covid-19 vaccine deal A group of lawmakers...

DPIIT Secy reviews infra projects in Jharkhand, Sikkim, Nagaland, Assam and Arunachal

New Delhi [India], June 26 (ANI): Amardeep Singh Bhatia, Secretary of the Department for Promotion of Industry and Internal Trade (DPIIT),...