CRH Continues Share Buyback Programme

ACCESS Newswire

20 Sep 2022, 11:31 GMT+10

DUBLIN, IRELAND / ACCESSWIRE / September 20, 2022 / CRH plc, the global leader in building materials solutions, is pleased to announce that it has completed the latest phase of its share buyback programme, returning a further $0.3 billion of cash to shareholders.

Between 16 June 2022 and 19 September 2022, 8.2 million ordinary shares were repurchased on Euronext Dublin at an average discount of 0.93% to the volume weighted average price over the period.

This brings total cash returned to shareholders under our ongoing share buyback programme to $3.8 billion since its commencement in May 2018.

CRH today also announces that it has entered into arrangements with UBS A.G., London Branch ('UBS') to repurchase ordinary shares on CRH's behalf for a maximum consideration of $300 million* (the 'Buyback'). The Buyback will commence today, 20 September 2022, and will end no later than 16 December 2022.

Under the terms of the Buyback, ordinary shares will be repurchased on Euronext Dublin. CRH has entered into non-discretionary instructions with UBS, acting as principal, to conduct the Buyback on CRH's behalf and to make trading decisions under the Buyback independently of CRH in accordance with certain pre-set parameters.

The purpose of the Buyback is to reduce the share capital of CRH and it will be conducted within the limitations of the authority granted at CRH's AGM on 28 April 2022 to repurchase up to 10% of the Company's ordinary shares in issue (being 55,827,503 ordinary shares following the completion of the latest phase of the buyback programme).

The Buyback will also be conducted within the parameters prescribed by the Commission Delegated Regulation (EU) 2016/1052 and the Market Abuse Regulation 596/2014 (including as it forms part of retained EU law in the United Kingdom ('UK') from time to time, and, where relevant, pursuant to the UK's European Union (Withdrawal) Act 2018 and the UK's Market Abuse (Amendment) (EU Exit) Regulations 2019) and Chapter 12 of the UK Financial Conduct Authority's Listing Rules. The repurchased ordinary shares will be held in treasury pending their cancellation or re-issue in due course.

Any decision in relation to any future buyback programmes will be based on an ongoing assessment of the capital needs of the business and general market conditions.

* Being an amount equal to €300 million (based on a FX rate of €1:$1 fixed for the duration of the Buyback).

***

Contact CRH at Dublin 404 1000 (+353 1 404 1000)

About CRH

CRH (LSE:CRH, ISE:CRG, NYSE:CRH) is the leading building materials business in the world, employing c.73,000 people at c.3,200 operating locations in 29 countries. It is the largest building materials business in North America and in Europe and also has regional positions in Asia. CRH manufactures and supplies a range of integrated building materials, products and innovative end-to-end solutions which can be found throughout the built environment in a wide range of construction projects from major public infrastructure to homes and commercial buildings. A Fortune 500 company, CRH is a constituent member of the FTSE 100 Index, the EURO STOXX 50 Index, the ISEQ 20 and the Dow Jones Sustainability Index (DJSI) Europe. CRH is ranked among sector leaders by Environmental, Social and Governance (ESG) rating agencies. CRH's American Depositary Shares are listed on the NYSE. For more information visit www.crh.com

Registered Office: No 12965. Registered Office: 42 Fitzwilliam Square, Dublin 2, R02 R279, Ireland

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact [email protected] or visit www.rns.com.

SOURCE: CRH PLC

View source version on accesswire.com:

https://www.accesswire.com/716650/CRH-Continues-Share-Buyback-Programme

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Detroit Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Detroit Star.

More InformationInternational

SectionMoscow removes Taliban from banned list, grants official status

MOSCOW, Russia: This week, Russia became the first country to officially recognize the Taliban as the government of Afghanistan since...

Netanyahu vows 'No Hamas' in postwar Gaza amid peace talks

CAIRO, Egypt: This week, both Hamas and Israel shared their views ahead of expected peace talks about a new U.S.-backed ceasefire plan....

US sends message by publicizing visa ban on UK punk-rap band

WASHINGTON, D.C.: The Trump administration has made public a visa decision that would usually be kept private. It did this to send...

Tragedy in Spain: Diogo Jota and his brother die in car accident

MADRID, Spain: Liverpool footballer Diogo Jota and his younger brother, André Silva, have died in a car accident in Spain. Spanish...

Early heatwave grips Europe, leaving 8 dead and nations on alert

LONDON, U.K.: An unrelenting heatwave sweeping across Europe has pushed early summer temperatures to historic highs, triggering deadly...

U.S. military, China, Russia in Space race

President Donald Trump's plans to build a space-based Golden Dome missile defense shield have drawn immediate criticism from China,...

Michigan

SectionScott Dixon edges Alex Palou at Mid-Ohio

(Photo credit: Gary C. Klein/USA TODAY NETWORK-Wisconsin / USA TODAY NETWORK via Imagn Images) Scott Dixon extended a remarkable...

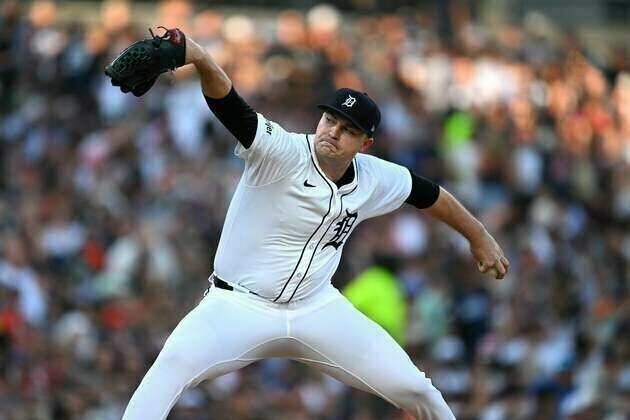

Tigers open it up in extras to hand Guardians tenth straight loss

(Photo credit: Ken Blaze-Imagn Images) Trey Sweeney and Riley Greene each belted homers in the 10th inning and Tarik Skubal threw...

Wizards acquire CJ McCollum, others in 3-team trade

(Photo credit: Bruce Kluckhohn-Imagn Images) The Washington Wizards completed a three-team trade on Sunday, acquiring guard CJ McCollum,...

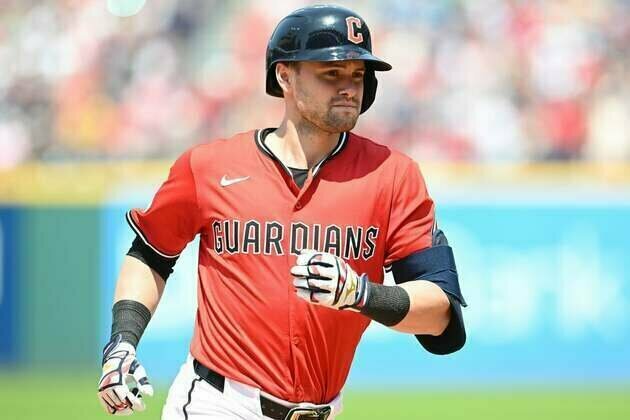

Guardians place OF Lane Thomas (foot) on injured list

(Photo credit: Ken Blaze-Imagn Images) Cleveland Guardians outfielder Lane Thomas returned to the 10-day injured list on Sunday because...

Tigers' Tarik Skubal looks to hand Guardians 10th straight loss

(Photo credit: Lon Horwedel-Imagn Images) Tigers left-hander Tarik Skubal's quest for a second straight American League Cy Young...

Diamondbacks look to Corbin Carroll in rubber game vs. Royals

(Photo credit: Patrick Breen/The Republic / USA TODAY NETWORK via Imagn Images) Arizona's Corbin Carroll was 0-for-5 in his return...